Olympic Footing

Sunday, August 12, 2012 at 01:26PM

Sunday, August 12, 2012 at 01:26PM In typical accounting fashion, now that the Olympics are over, I’m looking to see what adds up and what doesn’t. There are two items I couldn’t help but notice. The first is the Comcast announcement that they will break even on the purchase of the broadcast rights to the games, rather than lose $200 million. Company management said the reason this occurred was unexpectedly strong ratings. They also cited their much criticized social media efforts as key to bringing in the ratings.

In fairness to Comcast, presenting your earnings publicly is the best time to tell your version of the story. It would be absurd to think that management is objective in its presentation, particularly when the numbers provide an opportunity to validate a controversial strategy. It is worth noting though, that Accounting Today (whose latest issue you may have missed) had a different explanation. Although the ratings did come in better than anticipated, the reason the CFO could state that the event would be positive from an earnings perspective, was a write down taken on the cost of purchasing broadcast rights to the games. This is perfectly acceptable following current Generally Accepted Accounting Principles in the US, otherwise known as GAAP. The fact that it presumably helps the Comcast stock price around the performance of a troubled unit shows why accountants are more than bean counters. Either that or it shows how counting beans can add up to real money.

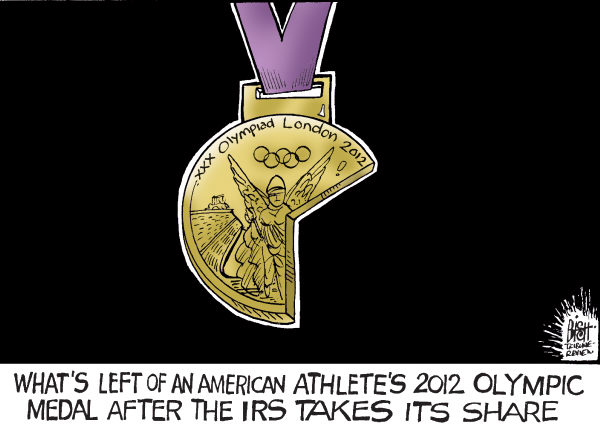

The other item that fell in the nexus of Olympics and accounting was the publicity about Olympic athletes’ prizes being subject to income tax. I’ll admit it’s not something I had thought about sooner. Still, it’s not exactly a shock that any income a US citizen makes is subject to tax. What is a startling is the context. The media headlines are full of legitimate concerns about Washington inaction on key tax issues. Still within a week there’s bipartisan support for a bill to exempt Olympic winnings from taxes. The Olympic movement symbolizes much of what is great in the world, and it’s been lots of fun to watch this year. On this tax topic though, I agree with Republican Senator Tom Coburn of Oklahoma, “If tax code gymnastics was an Olympic sport, the idea might get a medal.”